Risk Management

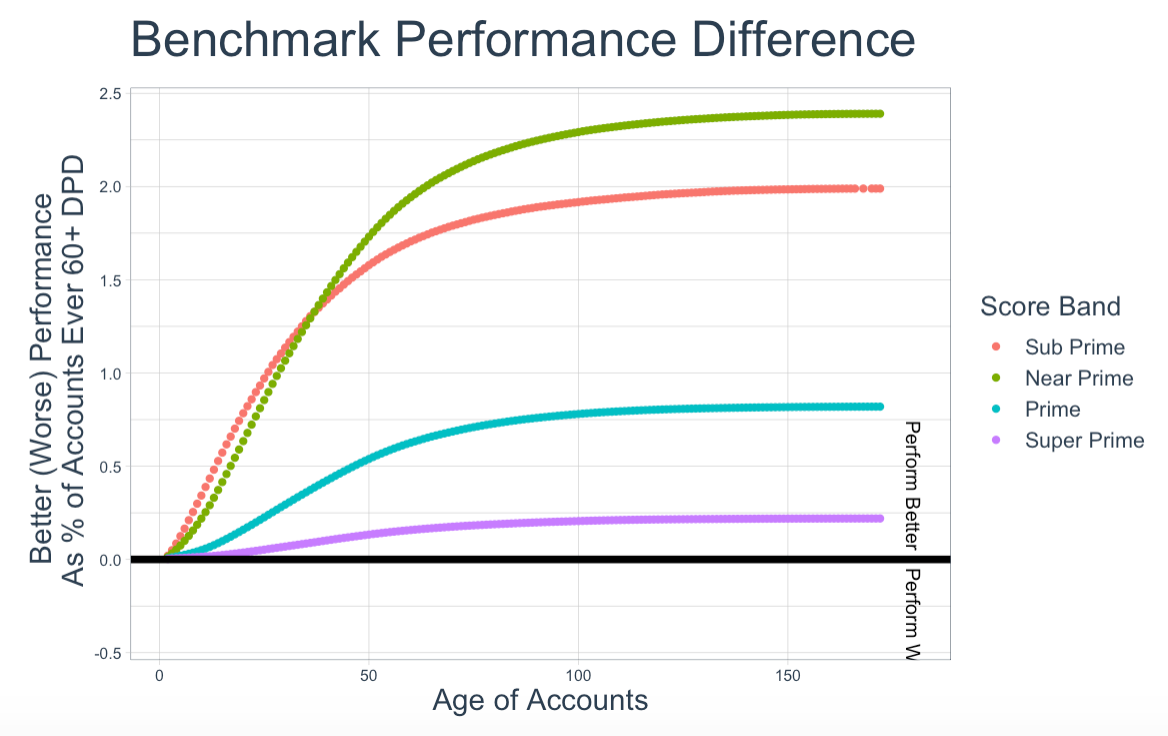

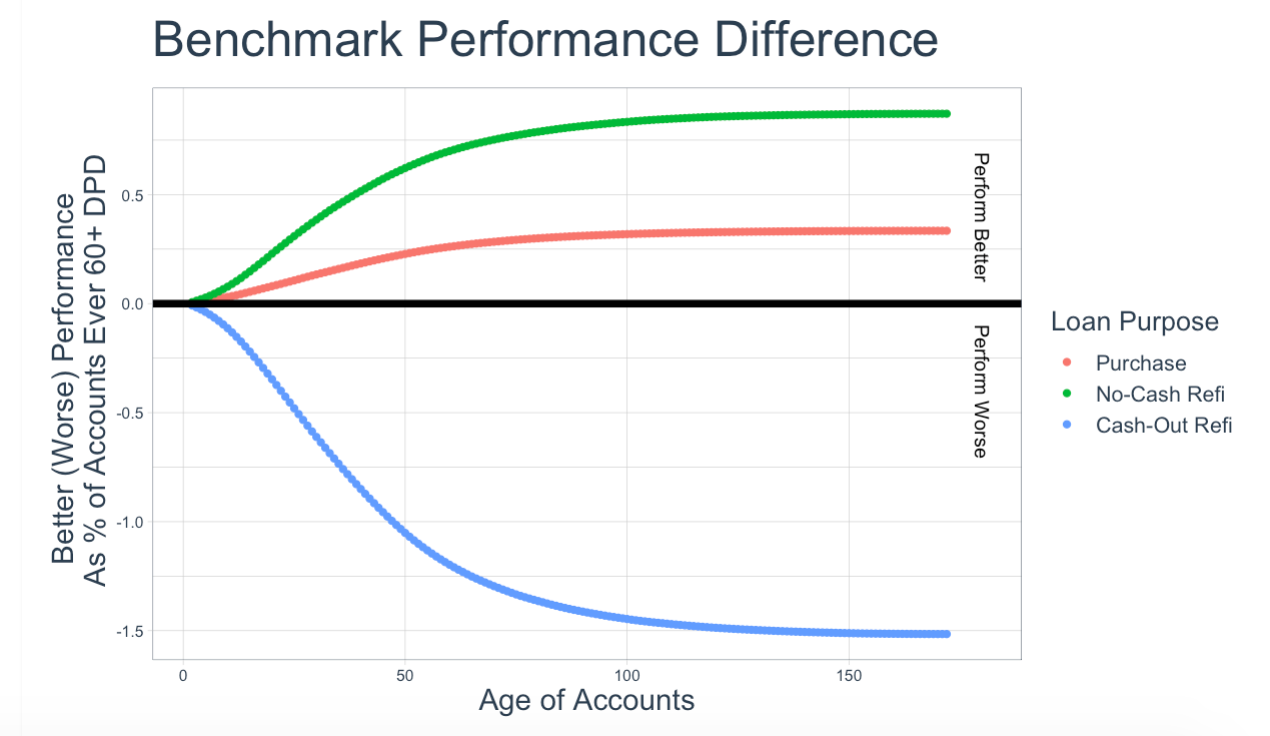

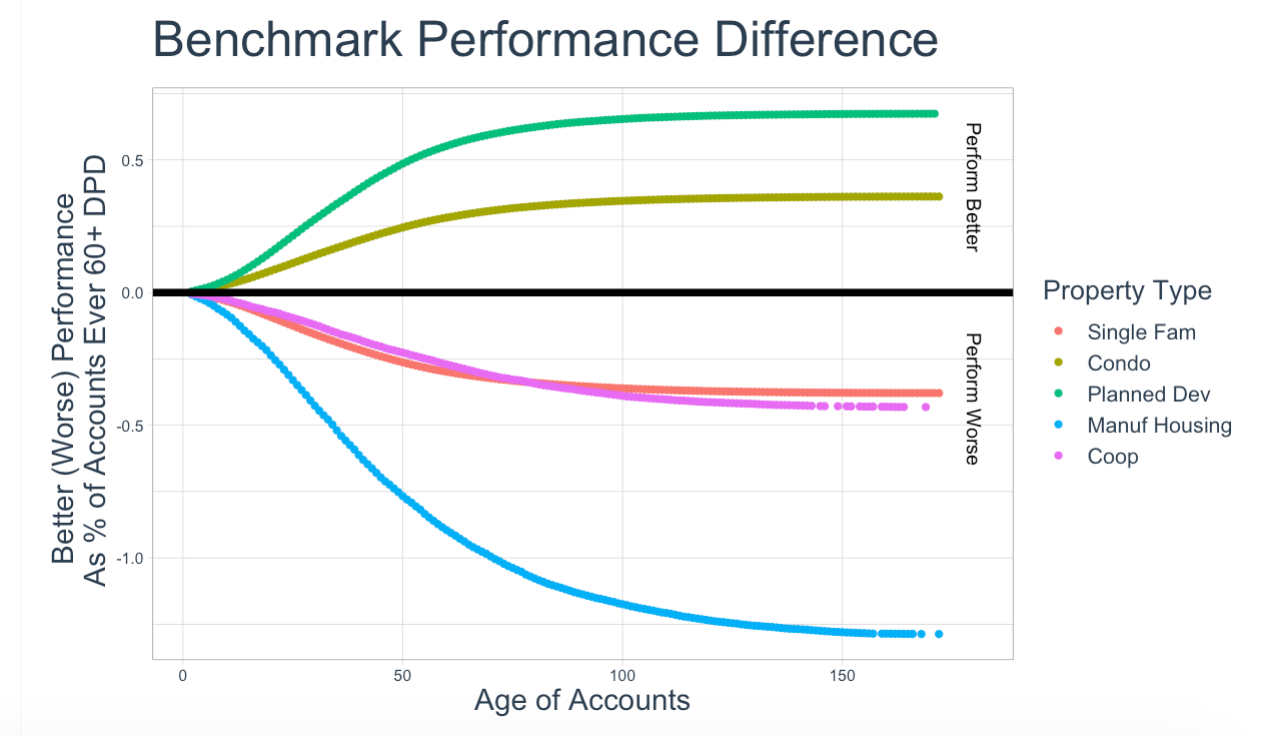

Compare the behavior of your accounts to an 'apples-to-apples' group by major dimensions such as credit score, product, and channel

Key Metrics by key segments:

Unit and dollar delinquency and loss rates

Average outstanding balance

Vintage analysis