User car prices rode a roller coaster last year tied to the pandemic. At the start prices dropped as pretty much everything shut down. But then as stimulus money hit homes and new car inventories shrank due to manufacturing cuts used cars also got hard to find. Economics kicked in and prices rose in response. The Washington Post tracked price changes in an article titled "

What used cars tell us about the risk of too much inflation hitting the economy". While the article largely focuses on inflation risk. we're more interested in the impact on default risk and collateral values.

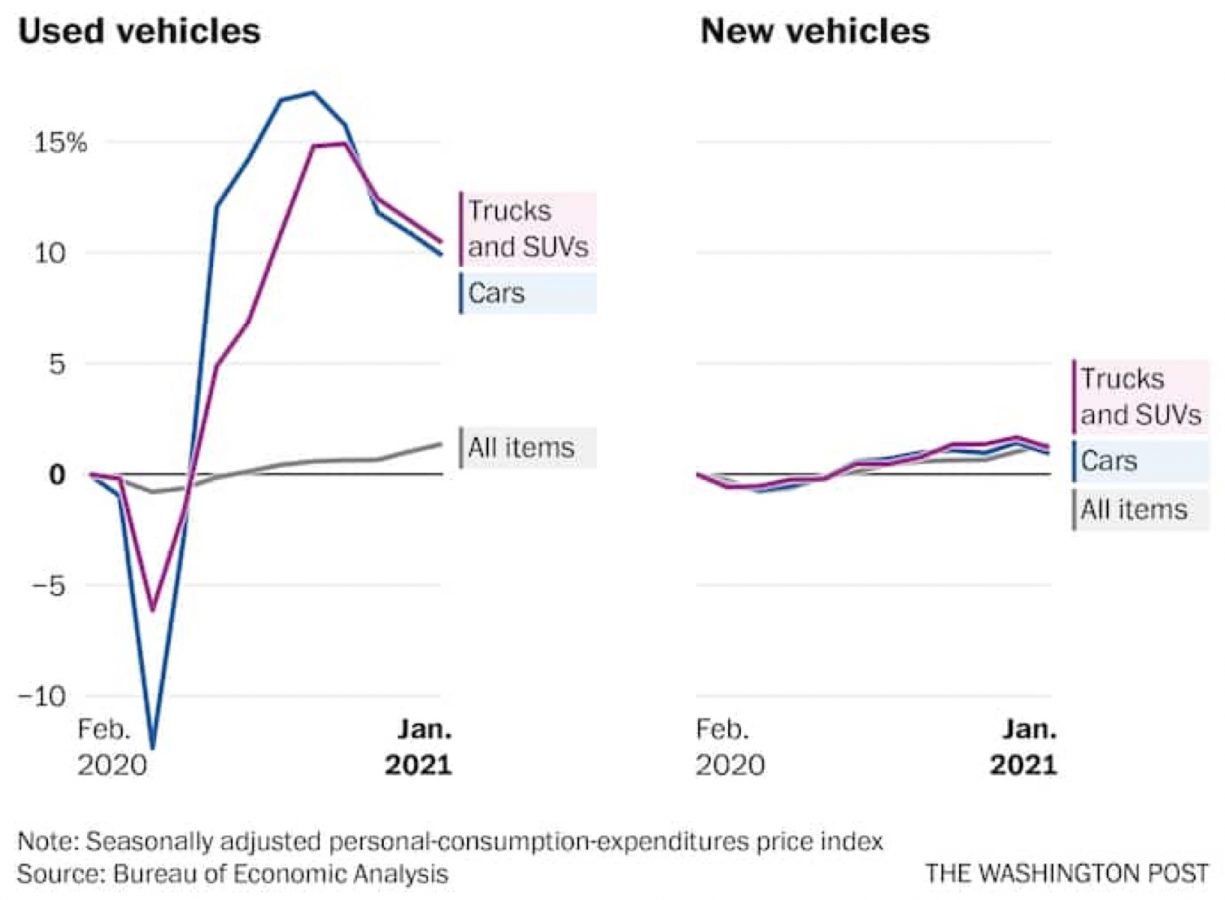

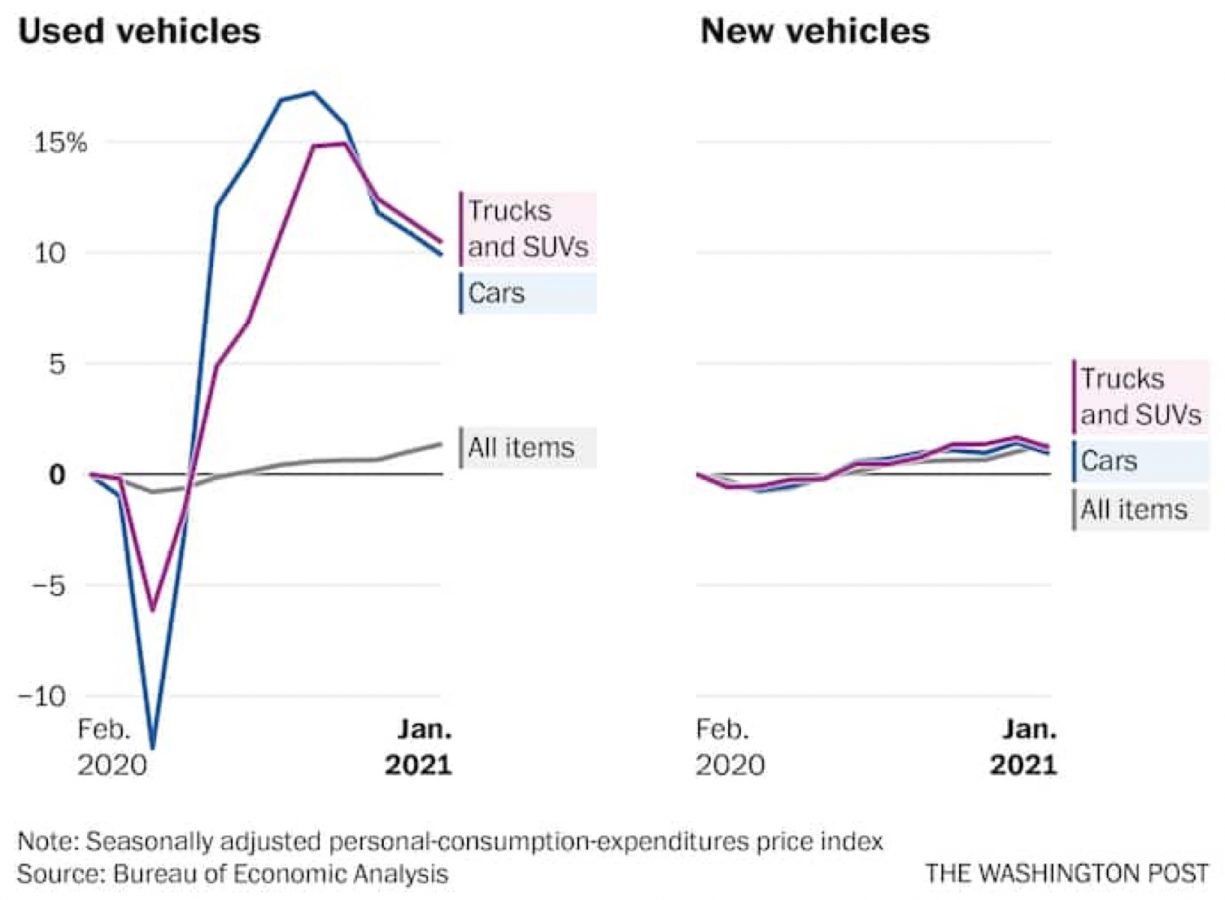

The roller coaster started with the pandemic as used car prices dropped by over 10% in March 2020 as shown in the graph. The quickly rebounded to recoup the drop and then rise a further 17% over the summer. Prices have since moderated and now stand about 10% above where they were 1 year ago. New car prices, in contrast, dropped modestly and are now only 1-2% higher than a year ago.

So what risks do price swings present to auto lenders? With any secured loans there are 2 risks, account default risk and collateral value risk. And as we saw in the Great Recession with home values, if collateral values decline sharply wiping out equity there's a good chance that default risks go higher.

Default risks will rise above historical levels if the number of jobs don't come back as everyone hopes. This could be exacerbated if supplemental unemployment benefits are not extended. Delinquency risk may have been 'hidden' by forbearance programs designed to aid borrowers in tough financial positions. For example, someone with a mortgage forbearance might have been able to continue their auto loan payments.

What happens when those programs end? Hard to know for sure. Perhaps rising home values will bail out homeowners who are able to tap the new equity in their homes. Will used car values hold up? That seems less likely. A return to 'normal' could occur over the next 12-18 months. A decline in value of a few thousand dollars is not likely to cause borrowers to walk away from their vehicles. But it could hurt collateral values enough to raise loss rates on loans made during this period.

It's an unusual situation. Typically you'd expect that used car values would decline during a recession as default rates increased. Under CECL, lenders should account for both economic shocks (more typically a recession) increasing default rates and changes in collateral values. Breaking the two out to model them separately probably makes the most sense. But the oddities of the pandemic change the calculus of reserve calculations. Perhaps the most important message here is how important it is to break out performance and forecasts by vintage. Tracking metrics at a detailed level will always pay benefits. The reward here is a more accurate CECL forecast when the time comes.