CECL Adoption Prompts Increase in Large Bank Allowances

Pandemic Has Had Even Greater Impact

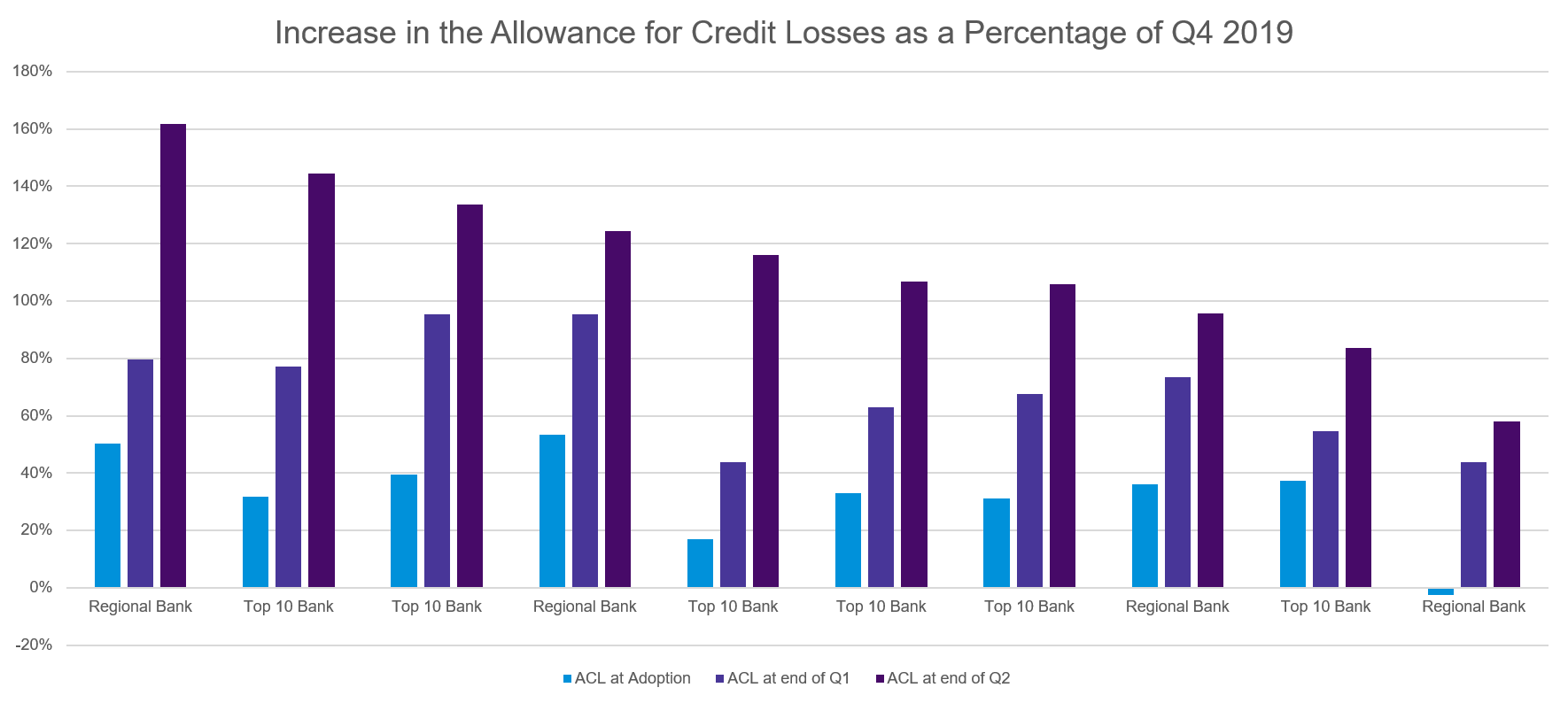

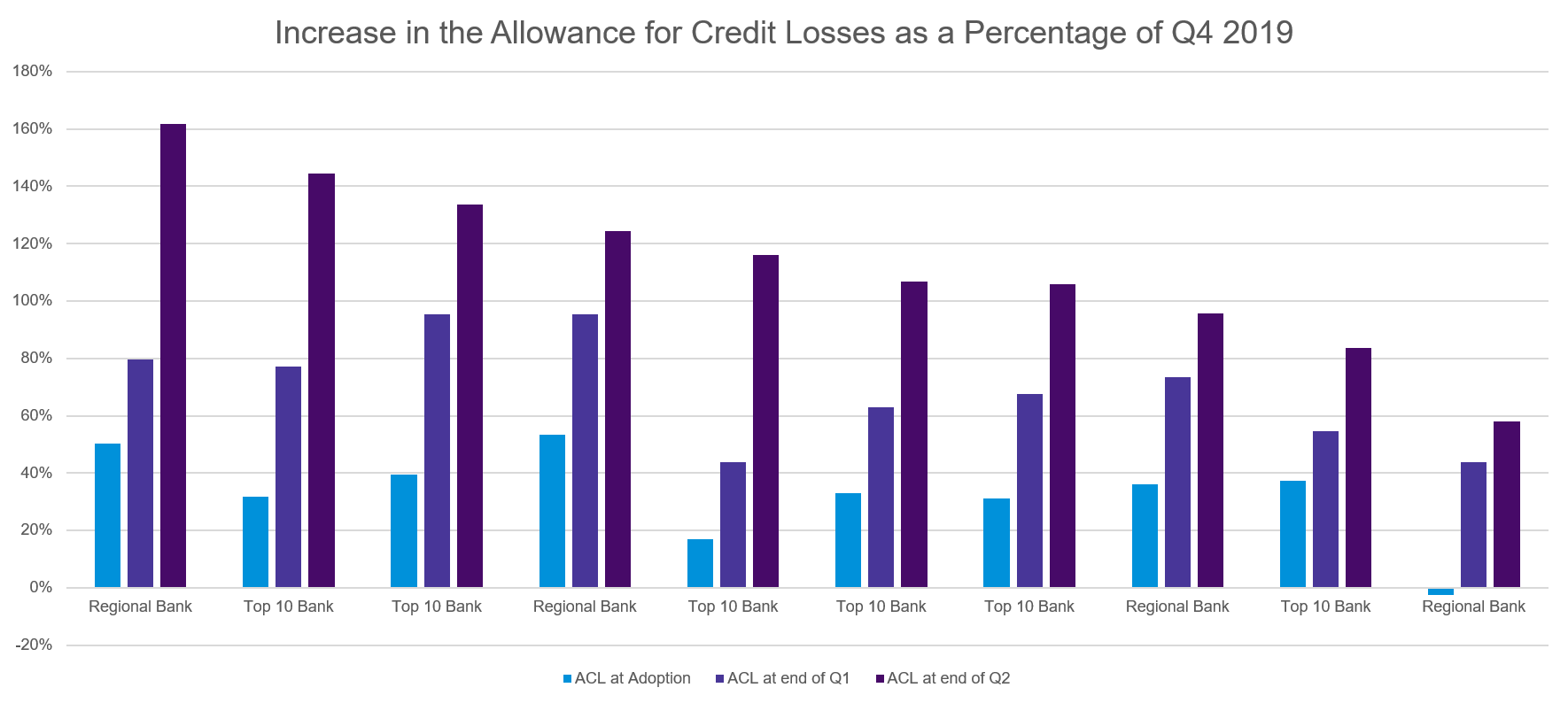

Large SEC filers adopted the new CECL accounting standard beginning on January 1, 2020. KPMG summarized the aggregate impact for 10 different banks at its 2020 National Banking Symposium. The chart below from this event details the percent increase in each bank's allowance due to adopting CECL in the light blue column:

CECL's impact ranged from a slight decrease to an increase of over 50% in the total allowance. Obviously a range of factors impact this including the types of loans (e.g., secured versus unsecured), customer risk profiles (e.g., subprime versus super prime), and how mature the loan book is. By analyzing life-time risk at the segment level banks are likely to come to very different totals compared to assessments at the portfolio level.

Perhaps what's most striking about the chart above is the increase that each bank saw in the first and second quarters of the year due to the pandemic recession. Based on the magnitude of the changes in each quarter it seems that each bank has used different sets of assumptions regarding the severity of the pandemic and its impact. One of the challenges that each bank will face when establishing their initial CECL reserves is how much economic uncertainty to build into their forecast. By default the future is uncertain. Considering how the economy will impact products and segments is a benefit of CECL that will impact both strategy and reserves.