This highlights the need to segment your portfolios into risk groups for more accurate CECL reserve calculations. Understanding how the risk profile of your portfolio is changing is a key element in developing future strategies and tactics.

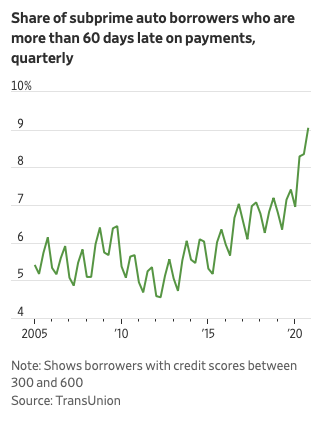

New subprime originations in 2020 are down as a share of all new auto loans, falling to 19% from 22% a year earlier per the article. This raises a question about what performance is like on a vintage basis. How much of the increase in subprime delinquency is being driving by a more mature portfolio with accounts moving into higher delinquency stages? Vintage analysis is a critical tool to measure whether newer account are performing better or worse than older accounts all at the same point in the customer lifecycle.

Vintage analysis combined with benchmarking makes for an incredibly powerful tool to understand pockets of risk and how to reduce future losses. The tools also help identify how you can grow your portfolios at low risk. Using the CECL

Now approach you can leverage the data to maximize its value.

Contact Us to get started now.