Credit Union Times presents some interesting information. Unfortunately the headline, "

Small Credit Unions Not Sharing in Recovery", seems not quite right. But it depends on your perspective.

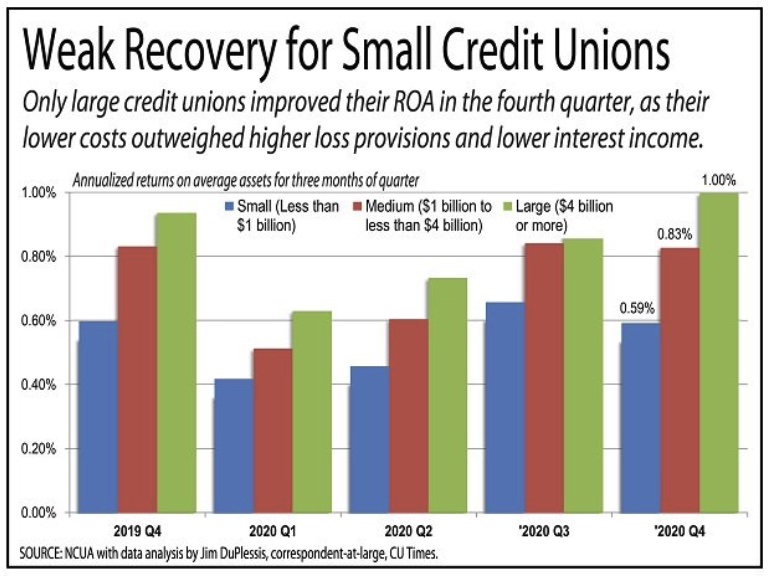

Overall credit union returns in Q4 2020 were at or above rates from a year earlier. The largest (over $4 billion in assets) had the best returns and the biggest change year-over-year. Return on assets was about 1.0% in Q4, up significantly from 0.62% in Q2 2020.

Smaller credit unions -- those with less than $1 billion in assets -- had returns of 0.59% in Q4. Hence the headline. The difference was attributed to "small credit unions' high overhead burden" which, quite logically, has always been the case. Smaller credit unions' returns were up from about 0.43% in Q2 but down from Q3's 0.63%.

That drop from Q3 should be more alarming. Assets for all credit union groups are up significantly over the past year. Combined with the sharp drop in interest rates this put pressure on net interest income.

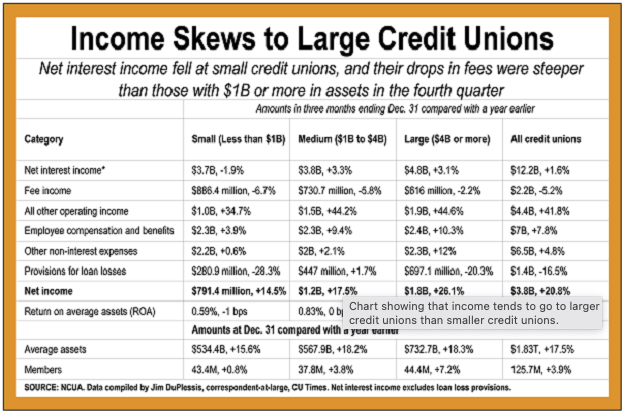

The breakdown of the income statement highlights key drivers by asset size. Interest income for smaller credit unions was down despite a 15.6% increase in average assets. This contrasts with increases of over 3% for larger credit unions.

Where the article seems to be wrong is that employee compensation and other non-interest expenses were both up much more for the larger credit unions. This seems to counter the argument that overhead costs were holding smaller credit unions back. As the table here shows ROA was down 1 basis point for the smaller credit unions, flat for medium-sized credit unions, and up 6 basis points for the largest. Returns for the smallest credit unions were aided by a 28% decrease in the provision for loan losses.